The screens are bigger. The data’s sharper. And the money’s moving fast.

In the past 18 months, a wave of private equity and strategic investment has flooded the OOH space—across premium billboards, smaller screens, and programmatic infrastructure. From urban spectaculars to regional rollups, capital is moving aggressively into a channel that’s increasingly measurable, digitized, and scalable.

Who’s Buying What (and When)

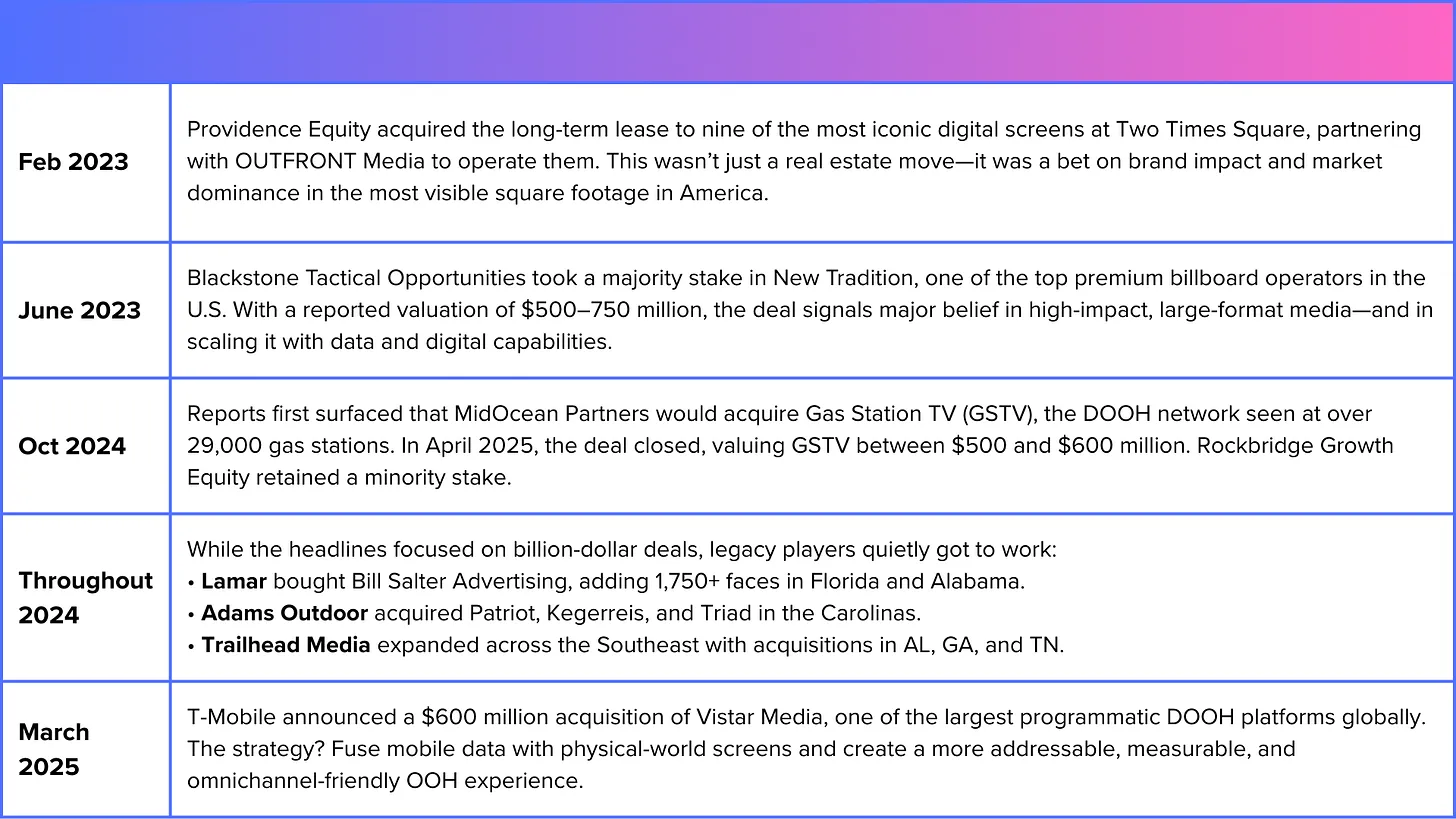

Here’s a quick-hit timeline of the most significant OOH investment and acquisition activity over the past two years:

Why It All Matters

This isn’t just M&A — it’s the foundation of a reshaped OOH landscape:

• Private equity is driving scale and digital acceleration.

• Strategic buyers like T-Mobile are turning OOH into part of the digital stack.

• Legacy operators are stitching together the mid-market.

Where Marny Road Fits In

We connect planning, activation, and optimization in one seamless, data-driven loop we call The Flow—designed to deliver precision, scale, and measurable outcomes across OOH media.

Whether it’s a traditional direct buy or a complex programmatic campaign, we help customers activate OOH that behaves like digital—only bigger, bolder, and unskippable.